Budget 2025 explained: the impacts for you and your rural business

Explore our detailed analysis, compiled from CLA tax and policy experts, on how the latest budget announcements affect rural families, their land and their businesses

Scroll down to read our analysis, subject by subject:

Inheritance tax

What was announced?

The Chancellor announced a slight concession to the government’s position on the proposed changes to agricultural property relief (APR) and business property relief (BPR). Following her announcement, the £1m tax free allowance will now be transferable between spouses and civil partners, bringing it in line with other inheritance tax nil rate bands.

What does this mean for members?

It will mean that when assets are held in one person’s sole name, there is no longer the need to transfer some of these to a spouse/civil partner in your lifetime or leave a gift of those assets in your will to a trust or your successors. It will therefore simplify the estate administration process for some members and should reduce the need for complex tax planning, changing property ownership and updating wills before the first death. It will also apply where the first death takes place prior to April 2026, meaning that widowed members will still be able to qualify for the transferrable allowance.

This will, however, not help the 46% of farms that are owned by a single farmer.

Increased taxes for landlords

What was announced?

The government is introducing new income tax rates for property, savings and dividend income that are 2% higher than the current rates of 20%, 40% and 45% (8.75%, 33.75% and 39.35% for dividends).

The property tax rate will be 22%, the property higher rate will be 42%, and the property additional rate will be 47%. These new property income rates will apply across England and Wales from 6 April 2027.

The income tax ordering rules will be changed from April 2027 so that the Personal Allowance will be deducted against employment, trading or pension income first.

This does not impact the use of specific allowances, such as the personal savings allowance and property allowance.

What does this mean for members?

Members with property income will pay more tax, and the income tax system will become more complex for members with multiple income sources. The change to the tax rules from April 2027 means that you will not be able to choose which source of income will use the personal allowance. This means that if you have trading income (such as from farming) or employment income over £12,570, the personal allowance will be applied to this income first and therefore all the property income will be taxed at higher rates.

Mansion tax

What was announced?

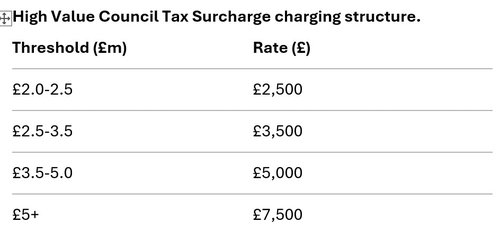

A High Value Council Tax Surcharge on properties worth over £2m, raising an estimated £0.4bn. This will be based upon updated valuations and will take effect from April 2028. It will be an annual surcharge on top of council tax.

Properties above the £2m threshold will be placed into bands based on their property value. Charges will increase in line with Consumer Price Index (CPI) inflation each year from 2029-30 onwards.

What does this mean for members?

No detail or methodology for the valuation exercise has been published yet.

The CLA will lobby for exemptions for parts of your house that are in sole agricultural use (e.g. a farm office), as well as exclusion for heritage properties and properties where there is dual use (where council tax and business rates are due).

If the properties within this value range are tenanted, the tenants will not pay the surcharge. What we have seen so far suggests that the surcharge on rented properties will be paid by the owner, but we expect this to be clarified by the time the planned consultation emerges in the new year.

Business rates (England Only)

What was announced?

The government announced a permanent lowering of business rates for 750,000 retail, hospitality and leisure (RHL) businesses which it says is worth more than £900m a year.

From April 2026, the RHL multiplier will be 5p below their national equivalents (ie. 32p and 43p). The government will allow itself flexibility to increase this for properties with a rateable value of above £500,000 with an additional 10p to the multiplier.

This is coupled with a more generous transitional relief scheme.

The government is also allowing additional access to small business rate relief for two years when a business grows into a second property.

What does this mean for members?

This is a welcome step for landowners operating diversified businesses, although it may not be enough for those still struggling to adapt to post-Covid trading patterns.

The extension of small business rate relief into a second property was a key CLA ask, and whilst this is time limited, it will help small businesses to expand. More generous transitional relief is welcome where members are faced with increases in their rates bills as a result of revaluation.

Tenants will cover business rates on let properties, so they will have the same benefits as businesses in owner-occupied properties.

Only those who occupy properties with a rateable value of over £500,000 may be due more tax under this measure, currently proposed to be 2.8p above the standard multiplier but with the flexibility to charge up to 10p.

Tourism tax

What was announced?

The Chancellor announced that English regions would be given the power to impose a tourism levy, or tax, on overnight stays. The actual amount of the tourism levy will be decided following a government consultation. It has been suggested that it could be a fixed amount per person, per night (of the stay) of £2.

According to the government consultation, mayoral and foundation strategic authorities will have the discretion to apply the tax through their respective areas, including rural areas.

What does this mean for members?

Experience in Wales has shown what can go wrong if a tourism tax is not implemented properly and where a government does not listen to rural tourism businesses. This must not be repeated in England. The CLA will be responding to the consultation and will set out the potential impact on the rural tourism sector in addition to developing ways in which a tourism tax can be implemented fairly and equitably.

Minimum wage

What was announced?

For workers over 21, the Chancellor announced a 4.1% increase in the national living, or minimum, wage for 2026/27. This means that the current level of the minimum wage at £12.21 per hour will increase to £12.71.

An increase of 8.5% from £10.00 per hour to £10.85 per hour has also been announced for workers between the ages of 18 and 20.

For those aged 16 to 17 years old and for apprentices, there will be a 6% increase from £7.55 per hour to £8.00 per hour.

What does this mean for members?

Any increase in the national minimum wage will mean additional staff costs for members, particularly those who operate diversified businesses. It is likely to have a negative impact on future investment and limit the scope for job creation.

Personal taxation

What was announced?

Income tax thresholds will continue to be frozen from 2028-2031.

The thresholds at which employees and the self-employed pay National Insurance (NI) contributions are being increased from April 2026.

What does this mean for members?

For tax year 2026/27, employees will pay NI if their income is above the new lower earnings limit of £6,708 per annum (£129 per week).

For the self-employed, where profits are less than £7,015 (the small profits threshold), there is no obligation to pay NI, although voluntary Class 2 contributions can be made. The Class 2 rate for tax year 2026/27 will be £3.65 per week, up from £3.50 a week. Where profits are £7,015 or more, Class 2 contributions are treated as having been paid to protect the individual's NI record. The threshold at which Class 4 contributions are paid remains unchanged for 2026/27 at £12,570.

Changes to pension contributions

What was announced?

From April 2029, employer and employee NI contributions will be charged on pension contributions made by the employee above £2,000 per annum made via salary sacrifice.

Salary sacrifice is when the employee agrees to reduce their gross salary or sacrifice a bonus and, in return, you – as the employer – pay the same amount into their pension.

All employer pension contributions will continue to be free of NICs.

What does this mean for members?

The introduction of NICs on pension contributions made via salary sacrifice would significantly weaken one of the few remaining straightforward tools that family farms and rural businesses use to fund employees’ retirement. At the moment, salary sacrifice allows both employers and employees to save income tax and NICs, so it is commonly used to boost pension savings for working family members and key long-serving staff without increasing the cost to the business. Once NICs are applied to the pension contributions, every pound saved in the pension would cost the employer an extra 15 pence and employee extra 6 pence. Employers and employees may both be under pressure to scale back their pension savings as a result.

Apprenticeship funding

What was announced?

The Chancellor announced that £725m will be made available through the Growth and Skills Levy to support apprenticeships for those under 25. This will mean that the training of Small and medium-sized enterprises (SMEs) apprentices under 25 will be fully funded.

What does this mean for members?

This is positive for those members who are keen on employing apprentices. We are aware that the government will be introducing a number of short training courses and we will be working with others to ensure that rural employers can benefit from apprenticeships, particularly at a time when labour availability remains limited.

Other announcements relevant to CLA members

Landfill tax (England)

The government has listened to the CLA and other organisations, and decided not to fundamentally alter the existing landfill tax regime. However, the government will increase the English lower rate (£8.65 per tonne for 2026/27) and the standard rate (£130.75 per tonne), up from £4.05 and £126.15 per tonne respectively. With a 100% surcharge on the standard rate for illegal disposals.

In its response to the government consultation on this idea, the CLA had emphasised the likely increase in waste crime, negative impacts on the delivery of environmental projects and as well as harming the supply of materials that are vital to the economy.

Fuel duty freeze to end in September 2026

The fuel duty freeze and 5p discount will be extended until September 2026.

The 5p cut will then be reversed through a staggered approach. From April 2027, the government said that the fuel duty rates would then be uprated annually by RPI inflation.

Fuel duty freeze to end in September 2026

The fuel duty freeze and 5p discount will be extended until September 2026.

The 5p cut will then be reversed through a staggered approach. From April 2027, the government said that the fuel duty rates would then be uprated annually by RPI inflation.

Devolution funding

The government is to allocate a share of the £500m Mayoral Revolving Growth Fund to the following Mayoral Strategic Authorities: Greater Manchester, West Midlands, Liverpool City Region, North East, West Yorkshire and South Yorkshire. The fund is a strategic investment partnership which will see central government and Mayors sharing risk to overcome access to finance barriers in key city regions, accelerating investment, unlocking development and boosting growth.

The government will also launch the Local Growth Fund for the Mayoral Strategic Authorities of Greater Manchester, North East, West Midlands, South Yorkshire, West Yorkshire, Liverpool City Region, Greater Lincolnshire, Tees Valley, Hull & East Yorkshire, York & North Yorkshire and East Midlands. They will each receive a share of £902 million over four years to invest in local infrastructure, business, and employment support and skills programmes.

The government confirmed £13bn of funding through integrated settlements from 2026-27 to 2029-30, previously announced during the Spending Review, for seven Mayoral Strategic Authorities: Greater Manchester, West Midlands, Liverpool City Region, West Yorkshire, North East, South Yorkshire and the Greater London Authority, representing nearly 40% of people in England.

For the devolved nations, Wales is to receive a further £320m in resource funding and £185m in capital fund, totaling £505m under the Barnet Formula. This is in addition to the Spending Review settlement.

Changes to ISAs

The Chancellor announced that the full £20,000 allowance will remain, but £8,000 of this will now be designated exclusively for investment purposes. Over 65s, though, will retain the full cash allowance of £20,000.

E-Invoicing

The government will require all VAT invoices to be issued in a specified electronic format from April 2029.